Phase01

Exporter/Seller Process

a) Looking for a plant authorized by SENASICA through FSIS in order to export to Mexico

Looking for a slaughter, processing, boning or cold storage facility listed by FSIS and SENASICA, which is near your farm and negotiating an agreement for shipping and receiving of export goods.

b) Contracting a freight forwarder

The freight forwarder manages the logistics process between the client hiring him and the services involved in transportation of goods to the destination Country.

Negotiate agreements with shipping companies, provides necessary documentation for shipping, arranges payments and requirements to release the load, plans the best route, most convenient costs, transit times, etc.

Advises the client, keeps him informed about all the route and load details, and is in constant communication. When choosing a freight forwarder, it is important to evaluate the following aspects –since the timeliness and agility for goods to cross the border to the destination Country depends on the freight forwarder:

• Has the capacity to handle poultry meat?

• Knows how to handle poultry meat?

• How extensive is his network of suppliers and collaborators?

• How is their communication?

• What is his experience in handling poultry meat?

In order to find a freight forwarder in the US, you may look on your own or click the following link of the National Customs Brokers & Forwarders Association of America, Inc.:

c) Contracting a customs broker

A customs broker is the individual, association or private company with a license given and regulated by the US Customs and Border Protection (CBP).

It helps importers and exporters to meet all the federal requirements governing importation and exportation of goods. It advises the client, keeps him informed about all the load details, and is in constant communication.

It is in charge of submitting the information and necessary payments to the CBP office on behalf of its clients in exchange for a fee for this service. It shall have the experience in the entry and exit procedures of goods, the destination Country requirements, customs tariff classification, assessment of tariff rates, as well as the taxes, permits and regulations required by the goods.

When choosing a custom broker, it is important to evaluate the following aspects –since the timeliness and agility for goods to cross the border to the destination Country depends on the custom broker:

• Has the capacity to handle poultry meat?

• Knows how to handle poultry meat?

• How extensive is his network of suppliers and collaborators?

• How is their communication?

• What is his experience in handling poultry meat?

There are more than 14,000 customs brokers with an active license. To find a customs broker in the US, you may look on your own or click the following link of the CBP office:

https://www.cbp.gov/contact/find-broker-by-port

d) Necessary documentation for buying, selling, shipping and arrival of goods in the destination country

• It is important to create an international agreement for the sale of goods between the supplier in the US and the buyer in Mexico (preferably in one single language for both parties) in order to set forth rights, obligations, price, INCOTERMS ® (international terms of trade) and taking care of transaction legal aspects.

• Creating a file containing documents that have been exchanged between buyer and seller, emails, notes, faxed letters, etc. in order to have a backup on the negotiations carried out.

• Packing list.

• Commercial invoice.

• Origin health certificate for exportation.

• Shipper Export Declaration Form.

• Certificate of origin, it is a “Self-Certification” shceme, it is no longer carried out by an authority.

IMPORTANT: The NAFTA certificate will no longer be used as of July 1st 2020, the certification is free as long as it contains the minimum data and can be presented in the invoice. The minimum data that must comply:

1. Indicate the certifier (Importer, Exporter or Producer)

Provide the certifier’s legal name, address (including country), telephone number, and e-mail address.

2. Certifier

Provide the certifiers’s name, title, address (including country), e-mail address, and telephone number of the certifier.

3. Exporter (if different from the certifier)

Provide the producer’s name, address (including country), e-mail address, and telephone number, if different from the certifier or exporter or, if there are multiple producers, state “Various” or provide a list of producers. A person that wishes for this information to remain confidential may state “Available upon request by the importing authorities”. The address of a producer shall be the place of production of the good in a Party’s territory.

4. Producer (if different from the certifier, or exporter)

Provide the producer’s name, address (including country), e-mail address, and telephone number, if different from the certifier or exporter or, if there are multiple producers, state “Various” or provide a list of producers. A person that wishes for this information to remain confidential may state “Available upon request by the importing authorities”. The address of a producer shall be the place of production of the good in a Party’s territory.

5. Importer

if known, the importer’s name, address (including country),e-mail address, and telephone number. The address of the importer shall be in a Party’s territory.

6. Description and HS tariff classification provide a full description of each good

For each good described in Field 5, identify the HS tariff classification to the 6-digit level. The description should be sufficient to relate it to the invoice description and to the Harmonized System (HS) description of the good. If the Certificate covers a single shipment of a good, include the invoice number as shown on the commercial invoice.

7. Origin criterion for the Goods

As set out in Article 4.2: Originating Goods of the C Rules of Origin state which Origin Criteria (A through D) is applicable. The rules of origin are contained in Article 4.2. Note: In order to be entitled to preferential tariff treatment, each good must meet at least one of the criteria.

8. Blanket period (date range up to 1 calendar year)

Include the blanket period, if the certification covers multiple shipments of identical goods for a specified period of up to 12 months as set out in Article 5.2 (Claims for Preferential Treatment).

9. Authorized signature and date

The certification must be signed and dated by the certifier and accompanied by the following statement:

“I certify that the goods described in this document qualify as originating and the information contained in this document is true and accurate. I assume responsibility for proving such representations and agree to maintain and present upon request or to make available during a verification visit, documentation necessary to support this certification. “

The certification could be presented in Spanish, English or French, however, it is recommended it be presented in Spanish (since a translation may be required).

The certification of origin may apply to

(a) A single shipment of a good to the territory of a Party; or

(b) multiple shipments of identical goods within any period specified in the certification of origin, but not exceeding 12 months.

The certifier could be the producer and exporter of the goods, the importer may issue it after 3 years and 6 months after the entry into force of the USMCA.

How to request preferential tariff treatment?

-

Through a certification of origin. (Purchase-sale invoices, inventory record, any document that proves that the originating materials were used to produce the merchandise in question).

-

Presenting documents that support and endorse the certification.

-

Making the free format with the minimum required data.

Official USMCA website in United States of America

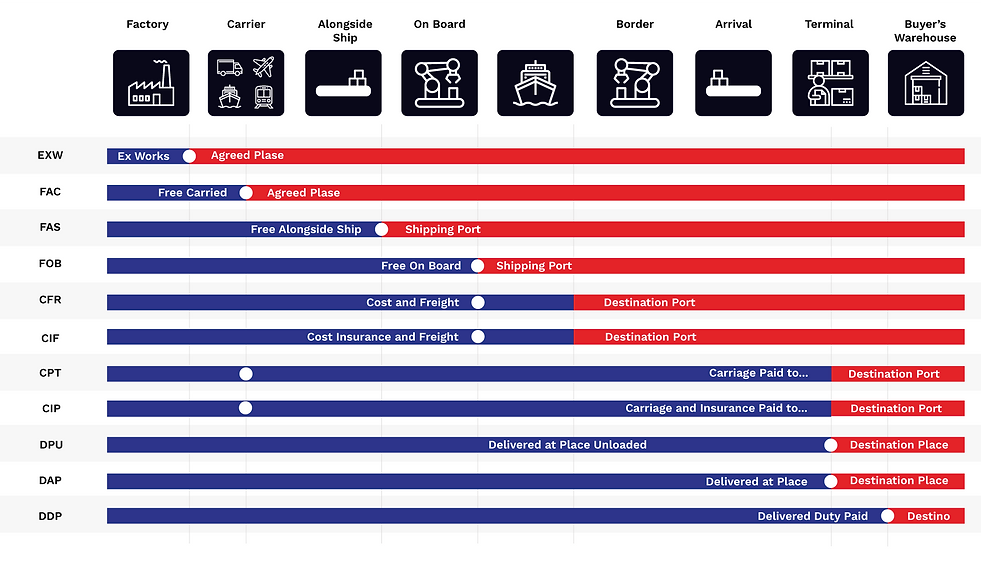

INCOTERMS (International Terms of Trade).

The main objective of INCOTERMS ® is to define costs, obligations and responsibilities between buyer and seller in the Agreement of an international trade transaction (they are published every 10 years), the main benefits of establishing INCOTERMS ® are as follows:

• They allow both parties to know to what extent or situation a transaction may generate risk.

• They are consistent and with legal recognition all over the World.

• In case of a litigation, investigation, controversy, or in the worst-case scenario, lawsuits, the legal entity that will take the case has uses and terms internationally accepted with criteria and sound bases to demand the compliance with obligations and responsibilities by the parties involved.

EXW Ex Works

-

The seller/exporter makes the goods available to the buyer in their own warehouse and is only responsible for packing the goods.

-

The buyer/importer therefore bears all of the costs and responsibilities from the moment the goods cross the warehouse prior to loading. Insurance is not mandatory but should it be required it would be taken out by the buyer as they bear the risk.

This Incoterm should not be used if the seller hands the goods over anywhere other than their own premises.

FCA Free Carrier

-

The seller delivers the goods to an agreed place and bears the costs and risks up to the point of delivery of those goods at the agreed place, including the cost of export clearance. The seller is responsible for inland transport and export customs clearance unless the designated place is the seller’s premises (FCA warehouse), in which case the goods are delivered there and loaded onto the means of transport arranged by the buyer at the buyer’s expense.

-

The buyer bears the costs from loading on board to unloading, including insurance if taken out because they bear the risk when the goods are loaded onto the first means of transport.

New for FCA, with respect to Incoterms 2010, is that in shipping the buyer can ask their carrier to issue a Bill of Lading to the seller specifying “on board” as proof of delivery of the goods, thus facilitating the use of documentary credits. The credit is afforded to the seller by bank guarantee although they are not party to the contract of carriage.

FAS Free Alongside Ship

-

The seller delivers the goods to the port of origin loading dock and bears the costs up to delivery as well as being responsible for export customs procedures.

-

The buyer is responsible for loading on board, stowage, freight and other costs up to delivery at destination, including import clearance and insurance, if taken out as it is not mandatory. The buyer also bears the risk once the goods are in the loading dock prior to being loaded onto the ship.

This Incoterm is only valid for shipping and is generally used for special goods that have particular loading requirements, not usually for palletized cargo or containers.

FOB Free On Board

-

The seller bears the costs until the goods are loaded onto the ship, at which point the risks are transferred as well as responsibility for export clearance and costs at origin. The seller also arranges the transport although the buyer bears the cost.

-

The buyer is responsible for the cost of freight, unloading, import clearance and delivery at destination as well as insurance should they take it out. The transfer of risk occurs when the goods are on board.

This Incoterm is only used for shipping. It should not be used for goods in containers because responsibility is transferred when goods are loaded on board the ship (the goods are in physical contact with the ship’s deck) and containers are not loaded on entering the terminal, therefore, if the goods were to suffer any damage inside the container it would be very difficult to establish when the damage occurred.

CFR Cost and Freight

-

The seller is responsible for all costs until the goods arrive at the destination port, including export clearance, costs at origin, freight and usually unloading costs.

-

The buyer is responsible for import procedures and transport to destination. They also bear the risks from the moment the goods are on board, hence, although it is not mandatory the buyer usually takes out insurance.

This Incoterm is only used in shipping.

CIF Cost, Insurance and Freight

-

As with CFR the seller bears all the costs up to arrival at the destination port, including export clearance, costs at origin, freight and usually unloading. However, unlike CFR, the seller must also arrange insurance even though the risks transfer to the buyer once the goods are loaded on board.

-

The buyer bears the import and transport to destination costs.

New in the 2020 version of this Incoterm is that the seller must arrange insurance cover in line with what is stipulated in Institute Cargo Clauses (C). In other words, the goods must be covered until their arrival at the destination port. This Incoterm is only used in shipping. It is widely used as it determines the customs value.

CPT Carriage Paid To

-

The seller bears the costs until the goods are delivered to an agreed place, i.e., they are responsible for all of the costs at origin, export clearance, the main transport and usually, costs at destination.

-

The buyer is responsible for import procedures and insurance if taken out as it is not mandatory. The risk is transferred to the buyer once the goods are loaded onto the first means of transport arranged by the seller.

This Incoterm is valid for any means of transport.

CIP Carriage and Insurance Paid To

-

The seller bears the costs up to delivery at an agreed place at destination, i.e., the costs at origin, export clearance, freight and also insurance which is mandatory.

-

The importer is responsible for import clearance and delivery at destination and takes on the risk when the goods are loaded onto the first means of transport.

What is new in this Incoterm with respect to Incoterms 2010 again relates to insurance cover. In this instance, apart from being mandatory, insurance must contain the same coverage as what is stipulated in Institute Cargo Clauses (A), the goods must be insured until their delivery to the carrier at destination.

DPU Delivered at place Unloaded

-

The seller bears the costs and risks arising at origin, packing, loading, export clearance, freight, unloading at destination and delivery at the agreed point.

-

The buyer is responsible for import clearance procedures.

This Incoterm is new and replaces DAT. In effect, it increases delivery options since DAT stated that delivery must take place at the terminal, whereas with the new DPU delivery can take place at an agreed place other than the terminal.

DAP Delivered At Place

-

The seller bears all the costs and risks of the operation apart from import clearance and unloading at destination, i.e., all costs at origin, freight and inland transport.

-

The buyer is only responsible for import clearance and unloading.

This Incoterm is valid for all means of transport. Insurance is not mandatory but if taken out the seller bears the cost.

DDP Delivered Duty Paid

-

The seller bears all costs and risks from packing and checking in their warehouses to delivery at final destination, including export and import clearance, freight and insurance, if taken out.

-

The buyer only has to receive the goods and usually unloads them, although this can also be done by the seller.

This Incoterm is the exact opposite of EXW, the seller bears all the costs and risks.

e) Make sure the importer/buyer meets the necessary requirements

-

That it is a person legally established in national territory and that his fiscal domicile coincides with that indicated in the corresponding documents and shall be current with its tax obligations.

-

He shall be registered in the Importers’ Registry before the SAT and importers list (Padron de Importadores del SAT; or, if it uses a trading company, it shall be registered in the Importers’ Registry.

What is the SAT Importers’ list?

An obligation for individuals who wish to import goods into Mexico, is to be registered in the Importers’ list. To this end, it is necessary to be current with the tax duties and to proof the Customs Authority that it is registered in the Federal Taxpayers’ Registry (RFC).

The registration in the SAT Importers’ list shall be made by Mexican importers. It is a simple and a free formality completed by filling out an electronic application in SAT’s web page.

It shall have an active Federal Taxpayers Registry ID (RFC).

It shall have the Customs Broker’s patent number with which it will perform the importation transactions.

The procedure is free of charge.

It shall have a business address reported and active before the SAT.

It shall not be under investigation by the SAT or the Mexican Government for any crimes.

The importer shall have a Customs Broker conducting customs clearance before the Mexican authority (who acts as its representative before the authority).

The SAT publishes the results of the requests on the Web Site, accessible using the Electronic Signature (FIEL) or password. For any enquiries, they can be requested on the same Web Site, and if the request is rejected, it may be generated again correcting any inconsistencies detected by the SAT’s personnel.